There have been recent newspaper reports about a perceived lack of accountability by the private schools participating in certain Scholarship Programs. This has created a lot of discussion about additional regulations that may be needed for these schools. We would like to take this time to discuss our view of this issue.

Let us start by reminding everyone that most scholarship families have already experienced what it is like to have their children in a well-regulated public school – many of which were also accredited.

Neither the regulations nor the accreditation made their zoned school a good fit for their children so these families sought out a different option – a scholarship to assist them in affording an educational setting that was a better fit for their children.

That means that scholarship families have already:

- Proactively chosen to remove their children from their zoned schools,

- Successfully completed the application process for scholarships,

- Enrolled their children in eligible private schools of their choosing, and

- Understood that they have the option to exit those schools if they are not meeting their children’s learning needs and to take their children – and scholarship funding – with them to another school.

They are not doing these actions mindlessly. Please do not be deceived by the fallacy that you must “protect” scholarship families from their choices.

Whereas one of the stated purposes of creating the Scholarship Programs is to expand educational opportunities, it behooves the state regulators to resist the urge towards over-regulating participating schools. Studies have proven that over-regulating these schools has the opposite effect – it constricts quality educational opportunities and subsequently decreases program effectiveness.

Instead, we encourage the state regulators to show scholarship families respect. Assume that they are the experts of their own lives and provide support for them as they work towards the goals they have already set for themselves and their children.

Here are some ways that we have found to do that:

- We provide parents with data on schools so that they can make informed decisions on selecting the best educational settings for their children. We provide access to licensed academic performance data on public, charter and private schools including ratings and reviews by parents, teachers, and students.

- We inform parents that their children’s scholarships are portable. They have the power to decide whether the chosen schools are serving their children well. If not, they can take their scholarships to another eligible school. This is the mechanism that weeds-out low-quality schools.

- We empower scholarship parents to demand to be treated like private-pay parents by private schools. Although they may learn about the scholarship from a school, the application process is between AAA and the parents. For us, the schools have no role in the process until the parents pro-actively select them – after being awarded a scholarship. We believe this helps underscore to the parents that they are not beholden to schools because they understand that the scholarships are not coming from the schools. Instead, parents are going into these schools with “money-in-hand” when they have a AAA scholarship.

- We remind them of all of these facts repeatedly – during application meetings, on scholarship applications, flyers, handbooks, award letters, and school commitment forms. Many families who have not had prior experience with the private school world need to hear these things multiple times before the feeling of empowerment becomes internalized.

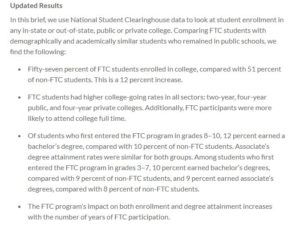

In Florida, we have administered both the Florida Tax Credit and Gardiner scholarships since 2014. Using our approach, more than 96 percent of FTC parents remain satisfied with the schools that they originally selected for their children. For those Gardiner students using their scholarship accounts for private school tuition that number is over 88 percent.

At AAA, we support the individual efforts of our scholarship families towards upward mobility. We do that by never assuming to know more about what their families need than they do. We encourage everyone to do the same.