Our Funders

Taxpaying companies and individuals who desire the opportunity to redirect their state tax liability directly into underserved populations and communities using education tax credits partner with AAA Scholarship Foundation. These smart decision-makers understand the positive social and economic benefits of investing in quality educational options for low-income families and families with disabled students.

Taxpaying companies and individuals who desire the opportunity to redirect their state tax liability directly into underserved populations and communities using education tax credits partner with AAA Scholarship Foundation. These smart decision-makers understand the positive social and economic benefits of investing in quality educational options for low-income families and families with disabled students.

Each state tax credit program has regulations determined by the laws of that state and the accountability guidelines of AAA. Select a state to view details on how that tax credit program works then contact our Development office at 888-707-2465 to speak with an expert about participating today!

The AAA Difference

About Us:

AAA Scholarship Foundation (AAA), a private non-profit 501(c)(3) organization, is an approved Scholarship Organization in the states of Arizona, Georgia, Florida, and Nevada. AAA is authorized to administer innovative state-approved education tax credit programs that fund scholarships primarily for children with economic, physical and/or intellectual disadvantages (up to grade 12). Qualifying families can use these scholarships to access the educational settings that best fit their children’s learning needs. The spirit of the income-based scholarship laws is to provide educational alternatives to a group of people who, because of financial circumstances alone, have none.

Click here for our most recent Form 990.

Click here for our most recent Audited Financial Statements.

Click here for our Donor Privacy Statement.

Click here for our Donor Frequently Asked Questions (FAQ).

Contact us for our CRA Credit Newsletter.

Click here for the IRS Safe Harbors.

Click here for AAA’s IRS 501(c)(3) Determination Letter

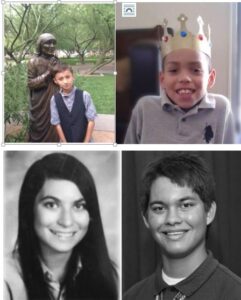

About Our Students:

The typical AAA scholarship student is either below grade level, failing at their previous school, or both, when they receive an income-based scholarship. Parents, who find their children in these circumstances and care about their future look for viable options. They seek an atmosphere that challenges and engages their child to reverse inappropriate learning and/or social patterns and the lifelong negative impact they imply. They wish to change their child’s learning environment, acquaintances and the unfortunate predictable outcomes associated with school failure.

Another is the first-time student, who is just entering kindergarten. Parents, wanting to empower their child’s academic journey from day one, choose the AAA scholarship so that their child will have a quality education tailored specifically for their learning needs ensuring their time in school is a seamless experience from K-12.

Click here for a list of recent studies on the effects school choice has for low-income students, their families and society.

Our Difference:

AAA Scholarship Foundation is different from other Scholarship Organizations because we:

- Award scholarships directly to families – not schools.

- Award income-based scholarships primarily to qualifying low-income families and scholarships to families of children with disabilities.

- Empower parents to choose the best schooling for their child(ren) – scholarships follow the children to each qualified educational setting as long as the family remains eligible.

- Award scholarships for at least a 3-year term when allowed because we understand that the continuity of an educational setting is important for children to succeed.

- Designate the use of interest earned on contributions to fund scholarships.

- Have a CPA on-staff to ensure that your tax questions are answered correctly and to ensure timely and accurate reporting.

What Constitutes a Good Scholarship Organization? Click here.