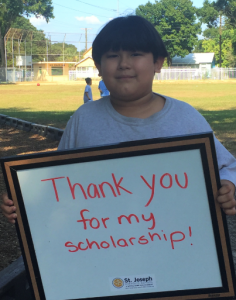

Michael Ramon

Michael Ramon

St. Joseph Catholic School

Tampa, FL

It was the fall of 2015 and – just like many other parents – Yazandra Ramon was nervous to send her youngest child, Michael, off to start Kindergarten at his area public school. She wanted to see Michael get a good start on his education and knew that the first years of school would be important to his future success. As a primarily Spanish-speaking family, she also wanted to make sure that Michael did not fall behind his peers. And the statistics back up her concerns. In Florida, 61 percent of 4th graders are reading below proficient, and that number jumps to 91 percent for those students who are English-language learners[i]. It is well documented that children who reach the 4th grade without adequate reading skills are more likely to drop out of high school, negatively impacting their future[ii].

To Yazandra’s relief, Michael did very well during his Kindergarten year. However, right before he was set to continue on to first grade at the same area public school, the Ramon family received bad news. They found out that Michael was now zoned for a different public school. Yazandra was worried about switching Michael from a school where he was excelling and decided to go visit the new school to get a better sense of the learning environment. Unfortunately, instead of easing her concerns, the visit to the school only increased them.

As she walked around the neighboring area thinking about a solution to her family’s dilemma, she came across St. Joseph Catholic School. Not knowing what to expect, she walked through the school doors and began talking with the staff about their school and academic program. Yazandra learned that St. Joseph was part of the Notre Dame ACE Academies and was impressed by the school’s curriculum and culture. To top it off, St. Joseph’s friendly and safe environment seemed to be a wonderful fit for Michael. The only problem was the tuition. The Ramon family works hard to make it on Michael’s father’s income as a construction worker, and there was no room in the budget to afford private school tuition. However, the school staff informed her that her family may be eligible for a Florida Tax Credit Scholarship from the AAA Scholarship Foundation to help cover the costs for Michael to attend the school. She immediately applied for the scholarship, hoping that it would be the solution she was looking for.

The day Yazandra received the scholarship approval letter from the AAA Scholarship Foundation, she was overcome with emotions of relief, joy and gratitude.

“Receiving the scholarship made me feel empowered as a parent,” she recalls. “I now had the ability to choose the school that I knew would be best for my son.”

Now in the first grade at St. Joseph, Michael loves his new school where his favorite subjects are math and science. He has also developed an interest in music and is learning to play the violin – an art he is able to further expand thanks to St. Joseph’s arts education partnership with Patel Conservatory, a fine arts training center in Tampa.

“The scholarship has been a true gift to our family and not one that we take for granted,” says Yazandra. “We are so thankful to the AAA Scholarship Foundation and its donors for giving our son the opportunity to learn and grow at a school that is right for him.”

About AAA Scholarship Foundation

The typical AAA Scholarship student is an ethnic minority living with a struggling single parent/caregiver in a high crime community. The average household income of families accepted to receive scholarships is $23,559 for a family of four. Many children are either below grade level, failing at their previous school or both when they receive a scholarship. Parents, who find their children in these circumstances and care about their future, look for viable options. They seek an atmosphere that challenges their child and will reverse inadequate learning, social patterns and the potential lifelong negative impact. They wish to change their child’s learning environment, acquaintances and the unfortunate predictable outcomes associated with school failure.

AAA Scholarships are funded in Alabama, Arizona, Florida, Georgia, Nevada and Pennsylvania by corporations that redirect a portion of their state tax liability to the AAA Scholarship Foundation in exchange for a tax credit (dollar-for-dollar in Alabama, Arizona, Florida, Georgia and Nevada, and up to 90 percent in Pennsylvania). The AAA Scholarship Foundation is one of the only approved Scholarship 501(c)(3) Nonprofit Organizations exclusively serving qualifying low-income, disabled and/or displaced students through these Scholarship Tax Credit programs. AAA Scholarship Foundation provides your company with the convenience and efficiency of a single-solution for participating in multiple state tax credit scholarship programs. For more information or to learn how your corporation can participate in the program, visit www.AAAScholarships.org, or contact Kerri Vaughan at kerri@aaascholarships.org or 888 707-2465 ext. 730.

Click here for a pdf of this student spotlight.

[i] Annie E. Casey Foundation “Kids Count Data Book 2014”

[ii] Annie E. Casey Foundation “Kids Count Data Book 2014”