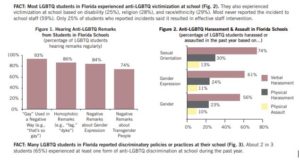

According to the most recent study released by the Gay, Lesbian & Straight Education Network (GLSEN), most LGBTQ secondary school students do not feel safe in Florida’s Public Schools.  If you have not had a chance to read it, the full report can be found at this link: School Climate Snap-Shot for Florida Public Schools

If you have not had a chance to read it, the full report can be found at this link: School Climate Snap-Shot for Florida Public Schools

That study illustrates why the Florida Tax Credit (FTC) Scholarship Program is so critical. Since it passed in 2002, it has been one of the only options a low-income family may have to provide their k-12th grade child who identifies as LGBTQ with an educational setting that is safe and better fits them. In many cases, an FTC scholarship may be the only escape for a low-income LGBTQ child who feels unsafe in their residentially-assigned public school.

We have never spoken to a parent who decided to participate in the FTC Scholarship Program because their child was thriving at their assigned school. They choose this route because their child is suffering academically or experiencing some form of discrimination or bullying. The beauty of the FTC Scholarship program is that it genuinely empowers parents with limited means to remove their children from otherwise harmful environments and into supportive ones where they can thrive.

You can follow this link to our blog post about why We Trust Parents which seeks to remind everyone that this program is 100% voluntary. No one forces a parent to participate or to have their child remain in any school that ends up being a bad fit (unlike residentially-assigned public schools). Parents have to work hard to get an FTC scholarship for their children, and they don’t just turn off their brains once their children get an award. They know that the scholarships are theirs to control – not the schools. If their first choice of a school isn’t a good fit, they know they can take their child – and their scholarship – to a different one. This real market force helps weed-out “bad” schools because ultimately, no one will choose to use their FTC scholarships there.

Companies that choose to participate in the FTC Scholarship Program are funding a student’s scholarship and empowering a low-income parent. They are NOT funding schools. They do NOT approve or accept schools. The scholarship parents choose where to use the scholarships.

Not every school will be a good fit – for the parent, the student, or the school. We wish every first-choice school were a good one but that may not happen for some. Nearly 2,000 Florida schools participate in the FTC Scholarship Program. It may take some work to find the right one but FTC Scholarship parents are not afraid to work hard – they’ve already proven that.

What is not okay is to force a parent to keep their child trapped in an unsafe school because scholarship funding is lacking due to misinformation or bullying tactics. When a company chooses to no longer participate in the FTC Scholarship Program because they have been told repeatedly by the media or on social media or berated publicly by a state legislator that they are funding non-inclusive schools, then they have made a decision based on misinformation or bullying.

Contributions to Scholarship Funding Organizations (SFOs) do not fund schools; they fund scholarships. SFOs award scholarships to students, not to schools. Scholarship checks are made payable to the parents, not to schools. This loss of scholarship funding means a company will be harming the very students they may be trying to help by no longer participating in the FTC Scholarship Program. Those responsible for the misinformation and bullying will have successfully trapped students in unsafe schools.

The Florida Tax Credit Scholarship Program transforms the lives of low-income children by empowering parents to choose where their children can achieve their ultimate academic potential regardless of their sexual orientation, ethnicity, or socio-economic status. We trust Florida Tax Credit Scholarship parents to make the most informed decisions about their children’s education and you should, too.